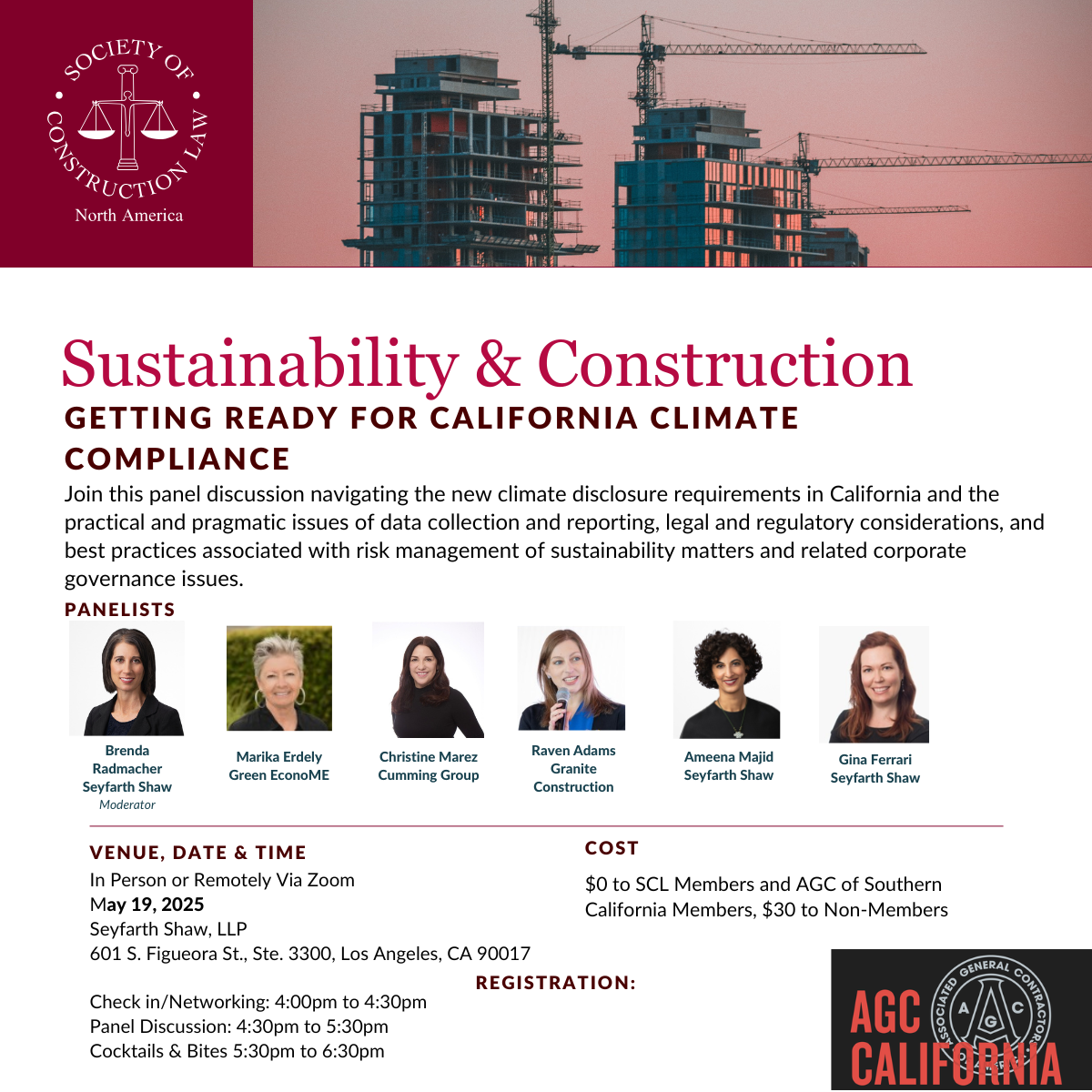

Sustainability & Construction Panel – Getting Ready for California Climate Compliance

Please join us as Marika Erdely, Green Econome CEO, joins a panel of experts to discuss navigating new climate disclosure requirements in California, data collection and reporting, legal considerations, and best practices associated with risk management of sustainability matters and corporate governance.

When: May 19, 2025

Venue: Seyfarth Shaw, LLP (601 S. Figueroa St. Ste. 3300, Los Angeles, CA 90017) or remotely via Zoom.

Schedule of events:

- Check-in/networking: 4:00 pm to 4:30 pm

- Panel discussion: 4:30 pm to 5:30 pm

- Cocktails and bites: 5:30 pm to 6:30 pm