Here at Green Econome, we've been at the forefront of ESG (Environmental, Social, Governance) reporting, eagerly anticipating the U.S. Securities and Exchange Commission (SEC) ruling on mandatory disclosures for public companies. Fundamentally, ESG is a way of doing business. Green Econome lives in the world of the “E”, the “Environmental” with our ENERGY STAR® benchmarking and energy and water efficiency services. While we recognize that the “S” and the “G” are equally important for businesses to report on, we are going to focus on the “E” and how that relates to the SEC’s new ruling. Let’s get into it.

Unpacking the SEC Climate-Related Disclosures

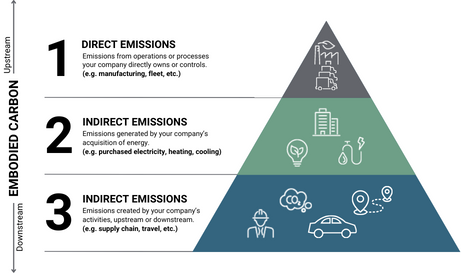

What are public companies required to report and how does that intersect with commercial real estate? On March 6, 2024, the SEC passed legislation requiring public companies to measure their Scope 1 and 2 emissions as part of their annual reporting and include how climate risk will affect their businesses in the near future. This ruling is meant to enhance and standardize climate-related disclosures. The SEC also included a materiality clause to help guide businesses as to what to report. Although, it's important to note that since March, there has been intense business opposition. But let’s get to the bottom line here: what are Scope 1 and Scope 2 emissions and why do we need to report on them?

Defining Scope 1, 2, and 3 Emissions

Basically, Scope 1 is for all direct Greenhouse Gas (GHG) emissions through the combustion of gas in buildings or by the business’ fleet. Scope 2 is indirect emissions for the electricity the business is consuming from the grid. Both emissions are part of the collection of data standard to ENERGY STAR benchmarking. Scope 3, although significant, was not included in the SEC’s ruling.

The ‘E’ in ESG is where Green Econome thrives

We are here to ENERGY STAR Benchmark your portfolio to meet your “E” goals and reduce the operating costs of your building. As a woman-owned, full-service energy and water efficiency construction and consulting company, we have over 20 years of combined experience. We provide accurate benchmarking services and insights to recommend solutions and incentives that will increase the NOI and market value of your property. Let us help you better understand and accomplish your property's ESG goals to reduce emissions and meet science-based targets (SBTi).

Contact Founder and CEO Marika Erdely

Mobile: 818-681-5750

Email: marikae@greeneconome.com