Here at Green Econome, we have many requests for ASHRAE Level 2 energy audit pricing, primarily for Phase II Audit & Retro-commissioning (A/RCx) requirements of the Los Angeles EBEWE Ordinance. So, what does this mean and why should you do it? On average, ASHRAE Level 2 energy audits can identify 10% - 20% in energy savings. This is just one of the benefits of understanding how your building operates and what can be done to increase the efficiency of the equipment. Let’s get into it.

Why are ASHRAE Energy Audits Required?

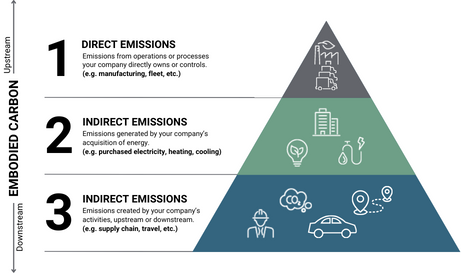

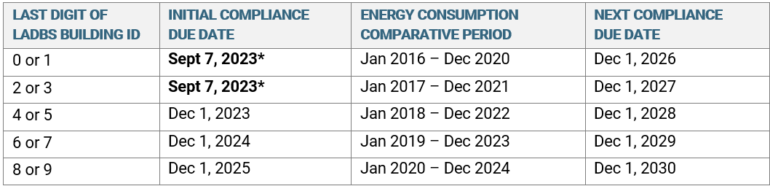

The demand for these ASHRAE Level 2 energy audits has risen due to the Building Performance Standards (BPS) that are popping up nationwide. These BPS are what Green Econome calls, “Phase II” of the current string of energy and water disclosure laws. Benchmarking, “Phase I” ensures that building owners understand HOW their buildings are performing, using the ENERGY STAR® Portfolio Manager® software. This benchmarking is an important first step that provides energy and water metrics for a property and compares it’s performance against itself and its peers.

Based on these benchmarking results, Phase II BPS requires building owners to meet certain energy and water reductions. When that doesn’t occur, legislation is focused on owners receiving ASHRAE Level 2 audits for their covered building(s). We should mention, any building can benefit from an ASHRAE Level 2 audit even if they aren’t required to have one performed. ASHRAE Level 2 audits provide WHY buildings are operating at certain efficiencies.

What's Included in an ASHRAE Level 2 Energy Audit?

Our ASHRAE Level 2 energy audits begin with an Executive Summary which provides general information on the size and use of the property and its overall energy and water usage and cost. We provide an outline of the recommended Energy and Water Efficiency measures and the estimated savings that would be reaped if the measures were implemented. Green Econome audits provide a table of total project costs and dollar savings with a simple payback in years. We love the Simple Payback calculation since it helps the owner understand how quickly the project investment is paid back vs. the utility savings earned. Generally, projects under 5 years have the most potential. Anything under 3 years should not be delayed due to the financial implications. And anything under 1 – 2 years is mandatory.

The next section of the report includes a Utility Analysis where we dig deep into understanding the energy and water usage of the building over a historical period. This analysis includes a breakdown of what energy and water equipment is used on a percentage basis. Through this analysis, any imbalance of energy usage can be identified. An example would be lighting that is more than 30% of the total energy load of the building. This section also includes usage and cost trend graphs, which identifies outliers of usage. This section also analyzes the utility rate structure which can reflect immediate cost savings if the property has been incorrectly charged by the utility.

Also useful in these audits is the detailed description of the existing energy and water consuming equipment at the property. Pictures are utilized, helping owners understand what is in their property. This section provides a snapshot of the equipment, which can be very helpful for owners to maintain for their records.

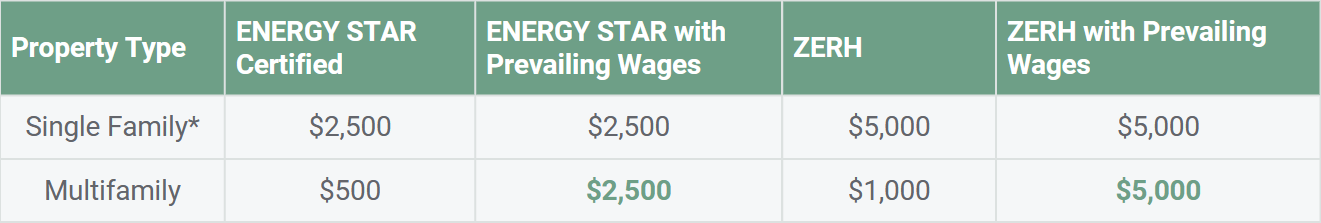

Lastly, the recommended energy and water efficiency measures detailed in the report explain what the benefit of each retrofit is. This section helps ownership understand what the desired effects of the retrofit provide. This is a valuable section, identifying any utility incentives that could exist to help pay for a project.

Audit reports should provide answers to all your questions on why to spend the money.

Get Started on your ASHRAE Energy Audit Today!

After reading an ASHRAE Level 2 energy or water audit report you should be able to understand how your property is performing, what equipment is consuming the most, what you can do to make your buildings more efficient. You will also have a clear understanding of the cost and how quickly you will reap the financial benefits. Benchmarking can be used to confirm the effectiveness of the retrofits in the next disclosure cycle.

Green Econome performs these audits on a weekly basis. Through auditing, benchmarking, and our entire suite of services, we have helped thousands of buildings and their owners stay on top of energy and water usage. Don’t wait to start saving! Contact us with any questions and to get your audit pricing today.

Do you have specific questions about complying with the Los Angeles Existing Buildings Energy and Water Efficiency Phase II A/RCx requirements? If so, visit our EBEWE ordinance webpage, or watch our chaptered video.