Let’s be honest, government writing is boring. These bills can be bothersome to read – I would be lying if I said I didn’t have to read it a few times before fully grasping its contents. That being said, SB 219 Section 1 has an interesting framework that will improve transparency for businesses operating in California and their contributions to greenhouse gas emissions.

SB 219 combines what was previously two separate bills (SB 253 and 261), consolidating them into one Corporate Climate Data Accountability Act. In this post we will cover what needs to be reported, who needs to report, and the implications of the SB 219 Section 1.

You should also see our post about SB 219 Section 2, the adjoining senate bill regarding climate-related financial risk.

What’s the Purpose of SB 219 Section 1 and Who Needs to Report?

The purpose behind this bill is to improve transparency and accountability amongst businesses that operate in California. The state recognizes that climate change poses a threat to companies’ long-term economic success and the value chains they rely on. Thus, emphasizing the importance of companies being transparent about their contributions to greenhouse gas emissions.

However, this bill does not apply to all businesses across the state. Reporting entities are any businesses (corporations, LLCs, Partnerships, etc.) that operate in California and had more than $1 billion in revenue in the prior fiscal year. This revenue standard applies to the entire business, not only the revenue generated in California.

Here’s the Specifics of SB 219 Section 1

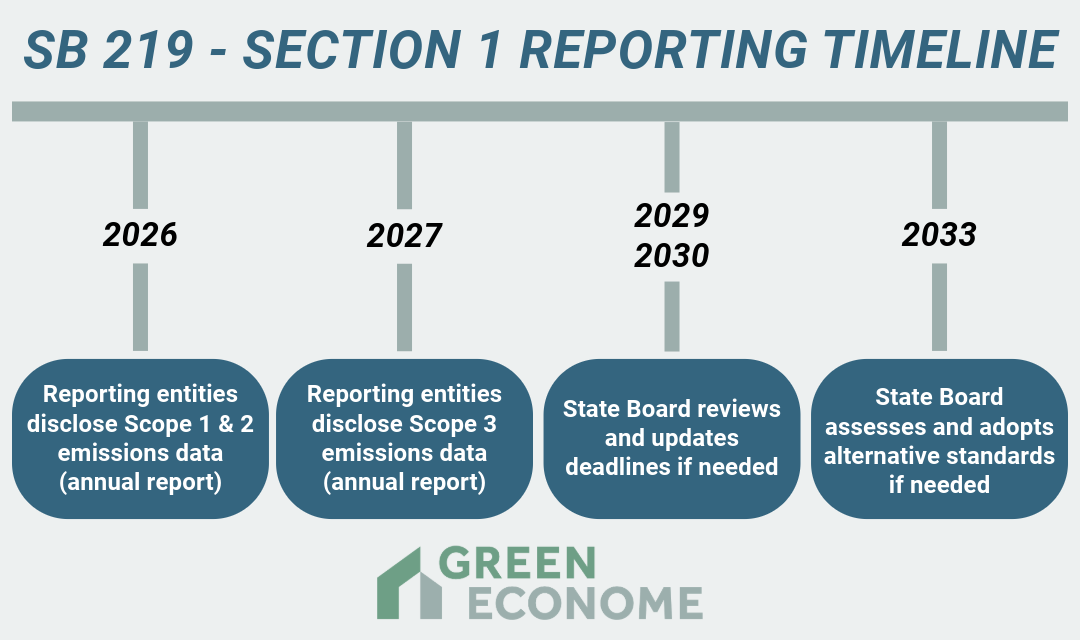

The California Air Resources Board (CARB) oversees the specific reporting requirements and ensures that the standards are updated as needed in the coming years.

Although that information has yet to come out, we do know it will focus on three types of emissions: Scope 1, Scope 2, and Scope 3. The first report on Scope 1 and 2 emissions will be due on or before January 1, 2026 and annually thereafter. CARB will set a later deadline for Scope 3 emissions reporting.

What Needs to be Reported?

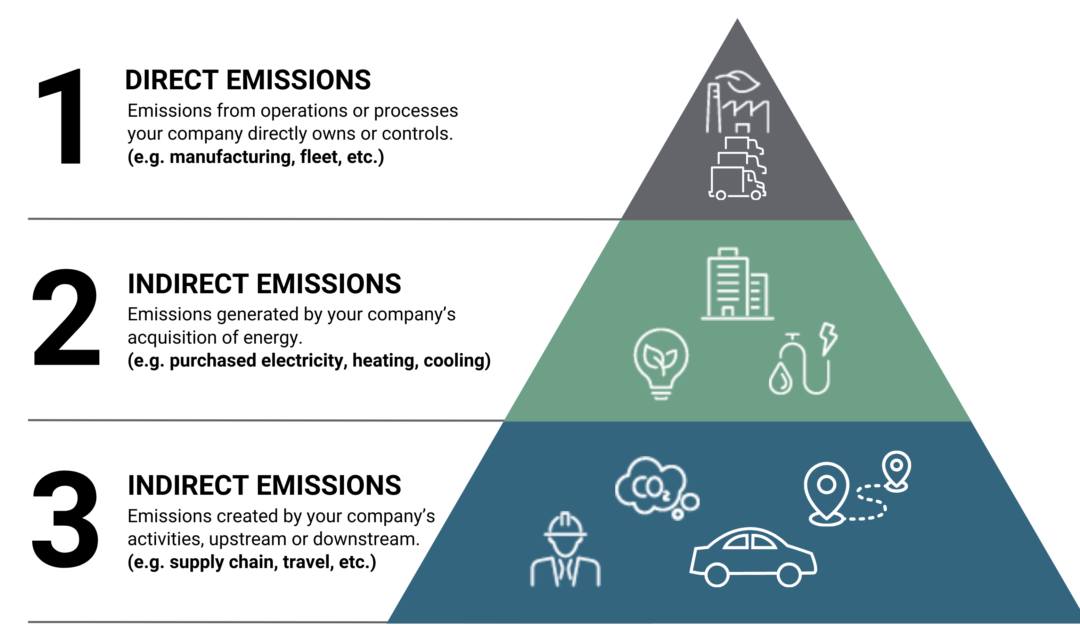

Scope 1 Emissions:

- All direct greenhouse gas emissions that stem from sources that a reporting entity owns or directly controls, regardless of location

- Including but not limited to fuel combustion activities

Scope 2 Emissions:

- Indirect greenhouse gas emissions from consumed electricity, steam, heating, or cooling purchased or acquired by reporting entity, regardless of location

Scope 3 Emissions:

- Indirect upstream and downstream GHG emissions, other than scope 2 emissions, from sources the entity doesn’t own or control

- May include but is not limited to:

- Purchased goods or services

- Business travel

- Employee commutes

- Processing and use of sold products

What is the Timeline?

Additional Points to Consider

In addition to creating and publicly disclosing the reports, reporting entities must also engage with a third-party assurance provider to ensure accurate information. Larger companies are able to report at the parent company level meaning subsidiaries do not need to report individually.

Upon submission of reports, businesses will also need to pay a fee to CARB that has yet to be set. If they fail to report, the board can distribute fines upwards of $500,000 depending on the case.

If you are worried about reporting your first cycle, it is worth noting that CARB has issued an Enforcement Discretion Notice. Thus, for the first reporting cycle, reporting entities are only required to report information that they are already tracking at the time of the bill’s passing.

How to Prepare

It is essential that businesses work on their data collection immediately and engage with reporting experts. Even though the first cycle has been slightly altered, these reports aren’t going anywhere. In fact, they are likely only going to become more extensive.

3 Ways We Can Help With SB 253 Compliance

1. Data Collection, and ENERGY STAR® Benchmarking

The foundation of SB 253 reporting is in the collection of data and benchmarking energy, water, and waste use. Benchmarking helps you develop a baseline understanding of your property’s performance and prepares your data for reporting.

2. Third Party Verification

After collecting all the required data for a report, it must be verified and audited for accuracy and compliance. Green Econome acts as a third-party verification entity by scrubbing data to evaluate and verify a company’s greenhouse gas emissions.

3. Consulting

If you are looking to further your emission reductions and save on operating costs, please reach out. Properties and businesses can save immense amounts of money by reducing emissions, lowering operating costs, and setting themselves up to report impressive data. Using the data collected, Green Econome can consult and provide businesses with strategic plans to increase efficiency and reach its savings goals.

Green Econome, a woman-owned, full-service energy and water efficiency construction and consulting company, has over 20 years of combined experience. We can help explain these complicated tax benefits and make sure your property is getting the most from them. Furthermore, we can recommend solutions that will increase the NOI of your property and increase market value. Feel free to reach out to Green Econome’s founder and CEO, Marika Erdely, at marikae@greeneconome.com.