Who knew when I started Green Econome in 2009 that my previous 30 years in accounting and finance would help building owners understand the opportunities provided by tax benefits in the Inflation Reduction Act (IRA), signed into law by President Biden in late 2022?

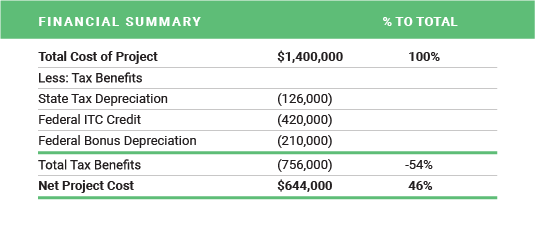

This significant package is heavily focused on how commercial real estate owners can invest in their properties to reduce operating costs and emissions by taking advantage of tax deductions and credits. Providing cash flow to owners, some of these benefits can be transferred to others, and non-profits can receive cash tax payments to help pay for these projects.

Let’s break down one of my favorites: Section 179D

This is a tax deduction. For those still learning about financing, a tax deduction is a reduction to the property’s income before tax liabilities are calculated. So, any of these deductions should be considered against the owner’s tax rate.

Section 179D has been around for many years and there is an opportunity to take the original deduction for 2020, 2021, and 2022. The new version, I call “IRA Section 179D” is effective with projects going into service after 1/1/2023.

When I started to research this deduction to help our clients increase their cash flow for these projects, it wasn’t clear that there were two specific periods to be considered for this deduction. The initial period is effective from 1/1/2023 – 12/31/2026. Beginning 1/1/2027, we have a new version (which is not as beneficial).

How is 179D calculated for your new construction or large retrofit project?

It all starts with an energy model. What is this? Well, it is a virtual design of your building. For the initial period, the energy model is a design of the property with the mechanical standards established by ASHRAE 90.1 2007. Note 2007! If you have a building that you are retrofitting in California to Title 24 2022, you are already way more efficient. LEED certification requires buildings to meet ASHRAE 90.1 2010 standards, so again, 2007 is much less efficient.

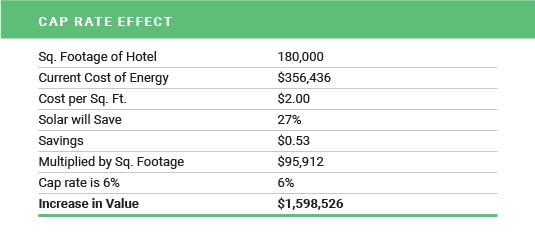

Next, the energy model is designed to the current material and efficiency standards the building is being built to or retrofit. The driver for this deduction is the “efficiency gain,” which is the difference between the energy used at the ASHRAE 901. 2007 standard vs. the current building code standard. For those projects requiring prevailing rates, the deduction is 5 times higher, which means it can be very significant.

The calculation is the sq. footage of the property multiplied by the corresponding rate based on the efficiency gain. This value is then multiplied by the owner’s tax rate... and there you have it: the anticipated tax deduction! The larger the property, the higher the deduction, but I believe smaller buildings may benefit based on the level of improvements planned.

Efficiency projects built together, pay together

When claiming the 179D tax deduction, it is most beneficial to have completed all the projects together in the same year. Green Econome is a woman-owned, full-service energy and water efficiency project construction and consulting company with over 20 years of combined experience. We can help explain these complex tax benefits and match you with a 179D specialist. Furthermore, we can recommend solutions that will increase the NOI of your property and increase market value. Get the ball rolling and reach out to Green Econome’s founder and CEO, Marika Erdely.