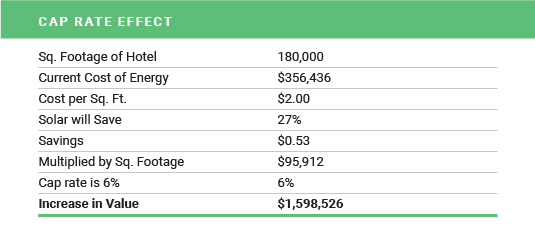

Solar PV reduces operating costs & increases building’s valuation

- Solar Energy is truly renewable. The amount of energy generated by a PV system reduces both the kWh used by a building and the building’s peak kW.

- The cost of solar-generated energy is much lower than the cost of energy purchased from a utility.

- Thanks to the longevity of solar systems (appx. 25 years), a solar PV investment will allow owners to reap financial benefits for years to come.

- The minute the system starts operating, Net Operating Income (NOI) increases.

- Stop relying on others for energy by creating your own on-site energy independence.

- Get Net Energy Metering (NEM) credit when excess energy gets sent back to the grid.

- Demonstrate to your employees, neighbors, and customers that you’re serious about “Going Green”.

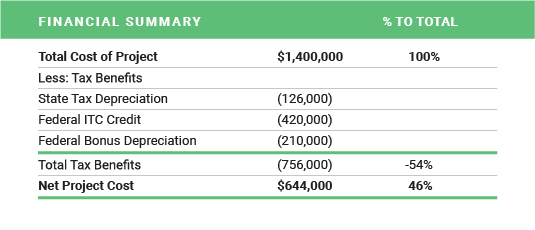

Solar Projects are eligible for the 26% Federal Investment Tax Credit (ITC). Installation of a new roof at the same time as the solar project, allows for 26% ITC on both projects. This Tax credit is dropping to 22% on January 1, 2021.

Here’s the proof:

A hotel client invested $1.4 million into solar PV systems to provide 27% of the hotel’s energy usage. With current tax credits and accelerated bonus depreciation, the project cost was reduced by 54%. Incredible.