Privately-Held Companies and Building Owners Can Benefit

What about private companies, and the private commercial real estate owners that lease to space public companies? Private owners should also focus on having an energy-efficient property and should not ignore the trend toward ESG.

The “E” in the ESG framework stands for “environmental,” which refers in part, to real estate and the efficiency of buildings. All buildings emit carbon emissions, and these emissions (in the forms of kWh and therms) can be broken down into three kinds: Scopes 1, 2, and 3.

- Scope 1: Direct emissions that stem from sources that are owned, or controlled by the organization, such as company vehicles and the fuel they burn, process emissions from industrial activities, leaks from refrigeration, etc.

- Scope 2: Indirect emissions that arise from the generation of purchased electricity, heating, cooling, and steam (Any utility bill creates emissions such as electricity or gas used by the building)

- Scope 3: Other indirect emissions that are directly from the supply chain of goods and services that the public company purchases. (This is the largest scope and most complicated coming from the organization’s operations, purchasing and selling goods, such as leased assets, business travel, and employee commuting)

Initially, Scope 1 and 2 emissions will be required to be disclosed by the SEC. However, public companies will soon be mandated to report Scope 3 emissions as well.

Mandated reporting means that if you have a tenant in one of your buildings that is providing products to a public company, the tenant will soon have to be reporting on their building’s emissions and activities. There will then be an effort to reduce those emissions, even if your building is not operated by a public company.

How Do You Measure Your Property’s Emissions?

As with anything new, standards and protocols are being established, along with a host of innovative technologies to harness data. As a trusted platform, Green Econome utilizes ENERGY STAR® Portfolio Manager, which gives owners data that can be used to calculate the property’s total emissions. The EPA is actively developing the platform further, to better meet the demands of GHG accounting and scope emissions reporting.

Green Econome takes a systematic approach to ESG, along with a team of advisors, we measure, identify opportunities, implement, and analyze results to ensure you are on target to achieve your environmental goals. If building certification is part of your strategy, we can fulfill those as well.

Inflation Reduction Act: Tax Strategies and Incentives for Property Owners

There’s good news! There are many financial benefits from the new Inflation Reduction Act of 2022 (IRA) to commercial property owners and developers.

Personally, I like the investment tax credit (ITC) known as the federal solar tax credit and the fact that it is now back up from 26% to 30% of the total project cost through 2033. Currently, our solar pv projects are benefiting from 58% of the project cost being covered by this tax credit and federal and state depreciation deductions.

Section 179 (a tax deduction) of the IRA provides owners with a dollar amount per square foot if the commercial or residential building meets a certain efficiency standard. Owners can earn $5 per sq. ft. for new construction or retrofitting a building, depending on its resulting energy efficiency. It is a laddered benefit ranging from $2.50 sq. ft. for a 25% reduction in energy usage up to a maximum of $5.00 sq. ft. for 50% or more.

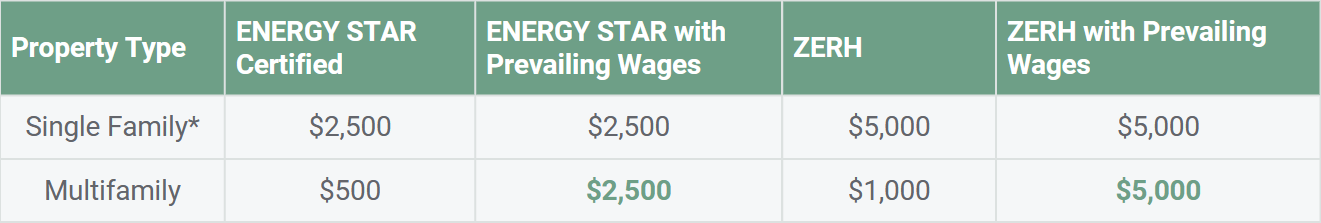

For multifamily landlords, Section 45L (a tax credit) allows up to $5,000 per unit (single-family or apartment) if the building meets certain energy efficiency criteria.

What’s In It For Commercial Real Estate?

Energy-efficient buildings will be worth more and will be more attractive for public companies concerned about emissions. Soon, everyone will be thinking about ENERGY STAR Benchmarking —a viable tool to produce data for reporting on your building’s performance.

ENERGY STAR Benchmarking is already widely used for energy and water disclosure laws across the county (and Canada). You can view IMT’s national map of programs currently in place.

As an expert in reducing commercial property emissions, I anticipate a big push to move real estate into the world of ESG reporting, which goes a long way toward environmental sustainability. Once the SEC finalizes its ruling, all public companies will be required to focus on the “E” on their buildings like never before. Additionally, I believe that when companies also consider the “S” for Social and “G” for Governance, they will ultimately be better stewards of the planet.

If you need an expert to understand your building’s energy or water efficiency and emissions, please reach out to me at Marika@greeneconome.com. At Green Econome, a team of professionals is ready to help you meet your ESG requirements, save operating costs, and increase the value of your property.