While there is a seemingly endless list of changes being made by the federal government, especially with respect to ESG and sustainability standards, many states are carrying on as usual. On the state level, New York, New Jersey, Illinois, and Colorado have joined California in continuing to uphold building performance standards.

With so much going on, let’s review existing standards and upcoming reporting deadlines to make sure everyone is up to date.

Reviewing LA EBEWE and Standards in SoCal

If you are reading this post and are located in the Los Angeles area, odds are you are already well aware of LA EBEWE. As a quick refresher, the City of Los Angeles Existing Buildings Energy and Water Efficiency program is a two-part ordinance. Phase I benchmarking required reporting for commercial buildings with more than 20,000 sq. ft. and no residential utility accounts, and residential buildings with more than 20,000 sq. ft. and 17 or more utility accounts. Phase II Audit/Retro-commissioning (A/RCx) requirements are due every 5 years and compliance is based on the benchmarking and performance results of the building.

Most currently, if your building ID from LADBS ends in 8 or 9, your compliance due date is December 1, 2025. That’s this year! While that may seem daunting, exemptions can streamline the entire process and save you money. You can dive into that here.

What’s Happening Across California?

AB 802 requires commercial buildings over 50,000 sq. ft. with no utility accounts and multi-family residential buildings with 50,000 sq. ft. and more than 17 utility accounts to make benchmarking reports annually.

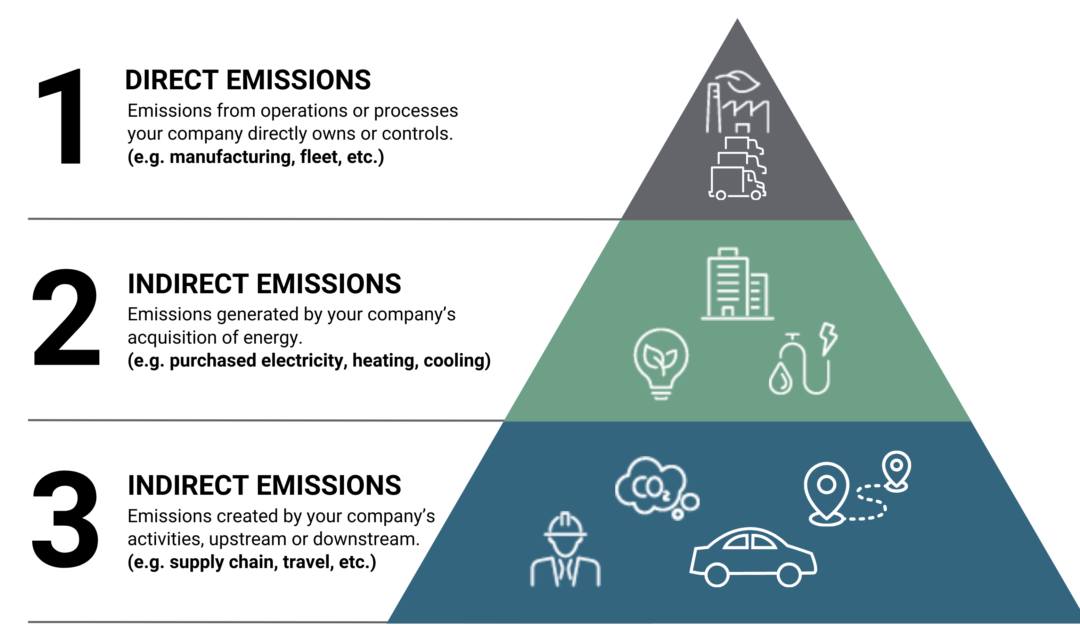

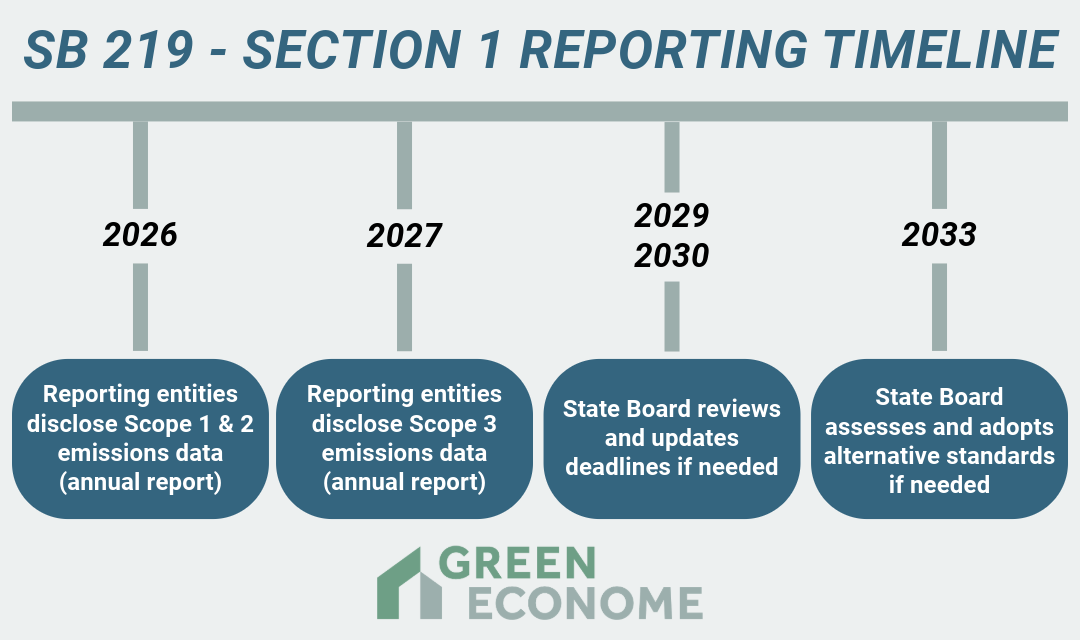

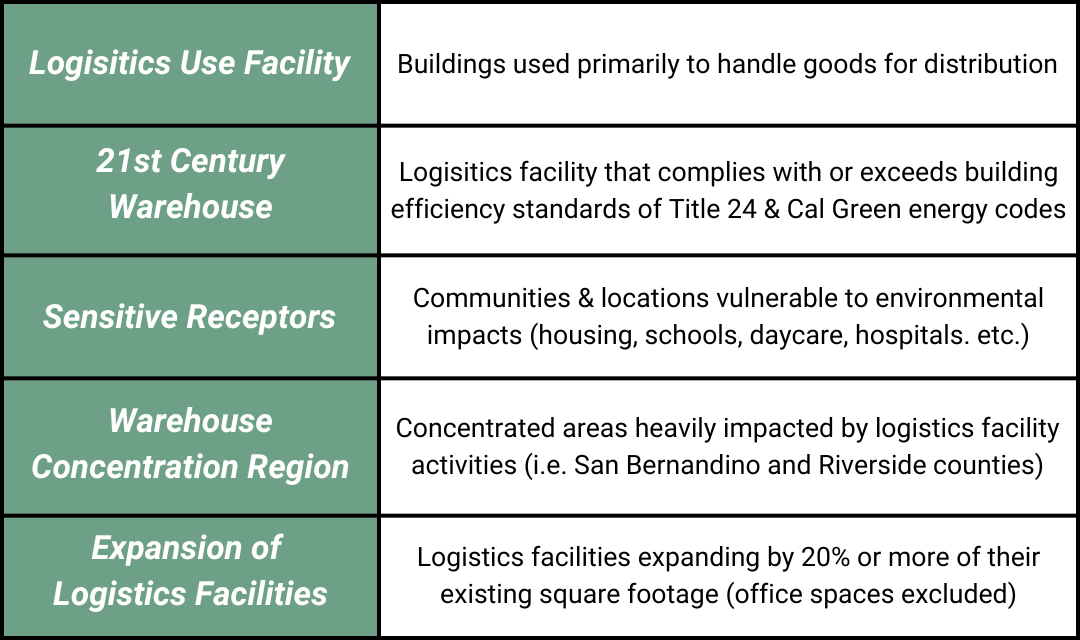

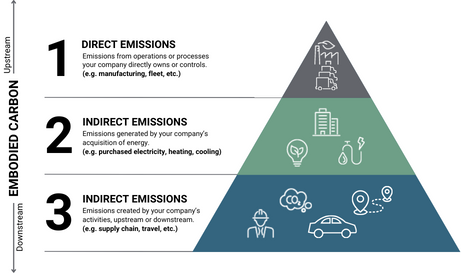

Beyond Los Angeles, the state of California has continued pushing energy compliance and reporting standards. Most notably, Senate Bills 253 and 261, and Assembly Bill 98. SB 253 and 261 are part of the state’s Corporate Climate Data Accountability Act, requiring businesses to report on their emissions and climate-related financial risks. AB 98, on the other hand, impacts warehousing standards, implementing several specific requirements for logistics use facilities of varied sizes.

Locally across California, many cities have ordinances like LA EBEWE such as:

States That Are Following Suit

You may be thinking “oh, well that’s just California”. Well, not quite. In addition to California, New York, New Jersey, Illinois, Colorado, and other states nationally have followed suit. Each has come up with their own reporting standards, along the lines of California’s reporting bills. It is likely that more states are coming.

Moreover, many cities across the country have local ordinances that will require various levels of reporting and building performance standards. Examples that come to mind are Boston BERDO and Orlando BEWES.

How Do I Afford the Reporting Process?

If you find that you are one of many who are required to report it can be daunting, especially financially. Luckily, there are many ways to fund the reporting and retrofitting process.

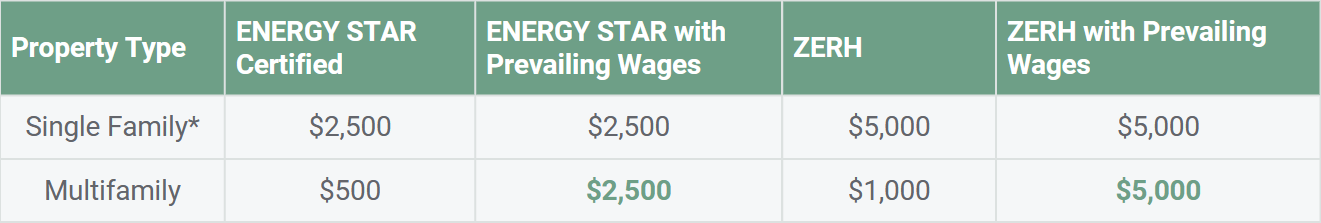

For LA EBEWE, the cost of meeting an exemption can be up to 65% less than receiving an ASHRAE Level II energy and or water audit and RCx report. If you are eligible, you can also gain ENERGY STAR Certification which can help with the lease rate and marketing of your property.

High performing, efficient buildings also save money on utility bills and attract higher value tenants that can help offset the costs of an audit or retrofit. There are also many opportunities for tax credits and other financial incentives for buildings that exceed standards depending on your region.

Where Can I Learn More?

Depending on where you are located, you should review the local and state requirements for your business or property. Green Econome specializes in consulting through these processes and has tons of informational materials for ordinances across the country.

The most important part is starting your benchmarking and audits now. These building compliance projects are not done overnight. By getting ahead of the game you will be able to offset future costs and reduce your current operating expenses.

Green Econome, a woman-owned, full-service energy and water efficiency construction and consulting company, has over 20 years of combined experience. We can help explain these complicated tax benefits and make sure your property is getting the most from them. Furthermore, we can recommend solutions that will increase the NOI of your property and increase market value. Feel free to reach out to Green Econome’s founder and CEO, Marika Erdely, at marikae@greeneconome.com.