After January 1, 2025, California will have effectively banned the sale and distribution of all fluorescent lamps per CA AB 2208. So, what does this mean for business owners and property managers? Those currently using these lamps must start planning to transition to alternative lighting solutions. Although this may require some planning and investment, upgrading to LED lighting is safer and more efficient, contributing to huge operational savings.

Why is CA Banning Fluorescents?

One of the biggest concerns with fluorescent lighting is safety; these lamps contain mercury, a toxic heavy metal that poses significant environmental and health risks. When disposed of in landfills, the mercury contaminates ecosystems through leaching into the soil and water. In addition to these environmental and public health threats, fluorescents are also incredibly inefficient compared to LEDs. They produce more heat bringing operational costs up across all systems and have a shorter life cycle.

Upgrading to LED lighting will save business owners money while protecting Californians’ health and safety.

Here is Your Lighting Retrofit Action Plan

- Ban Date

- January 1, 2025 (screw and bayonet base CFLs banned starting 1/1/24)

- Next Steps for Business Owners

- Assess Inventory: How many lamps do you have in stock? This will help you plan and prioritize when to implement an LED lighting retrofit.

- Budget for Retrofit: While equipment may be compatible, it is best to scope out the project needs to ensure safety and compatibility. Long-term cost savings of proper LED lighting retrofits are higher than the short-term gain of simply replacing bulbs. Not to mention, safer for the occupant.

- Properly Dispose of Fluorescents: Become familiar with your local regulations, procedures, and disposal facilities to ensure lamps can be removed, recycled, and disposed of properly. The EPA provides helpful information and resources for commercial use.

- Retrofit Priorities

- Decide project goals and budget.

- Assess and identify lamp counts, high-burn areas (parking garages, stairwells, etc.), and other inefficiencies to address.

- Explore your options and determine the best equipment and products for each area.

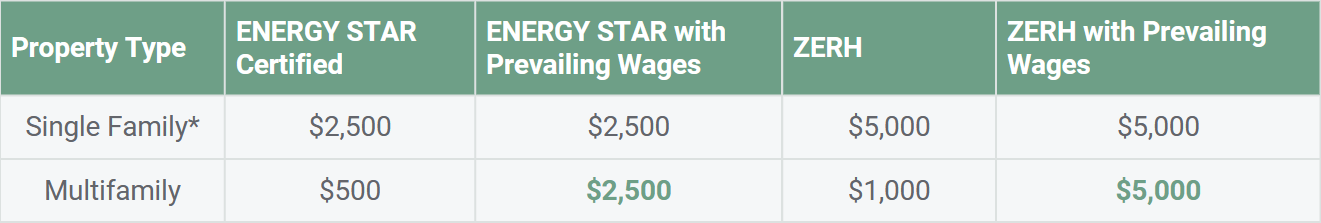

- Take advantage of utility incentives and rebates, while they are available.

- Measure and verify your energy and cost savings through bill analysis and/or benchmarking the building.

Green Econome Specializes in LED Lighting Retrofits… We Can Help You Transition!

Hiring a professional service provider often leads to the best results. Leverage their knowledge and access to contractors/distributors. Get ahead of the ban and take advantage of current incentives for energy efficiency upgrades. Business owners will save money and help keep their community safe by switching to LED lighting! In addition to upgrading the building’s lighting, Green Econome delivers a pre/post-install analysis to track savings. While we have implemented a variety of LED retrofits including, office, residential, and sport lighting, One of our biggest retrofit projects was conducted for a global aerospace company and ultimately resulted in a 25% cost reduction. This retrofit included lighting, HVAC, and thermostat systems. Green Econome is here to help you start saving now!